are federal campaign contributions tax deductible

Political contributions deductible status is a myth. Charitable contributions are tax deductible but unfortunately political campaigns are not registered charities.

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

Many believe this rumor to.

. The amount of charitable contributions of food inventory a business taxpayer can deduct under this rule is limited to a percentage usually 15 percent of the taxpayers. You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. To put it another way financial.

A tax deduction allows a person to reduce their income as a result of certain expenses. Federal political contributions are donations that were made to a registered federal political party or a. Resources for charities churches and.

A tax deduction allows a person to reduce their income as a result of certain expenses. Advertisements in convention bulletins and admissions to. The following materials discuss the federal tax rules that apply to political campaign intervention by tax-exempt organizations.

Political contributions arent tax deductible. Your tax deductible donations support thousands of worthy causes. The IRS has clarified tax-deductible assets.

Among those not liable for tax deductions are political campaign donations. Anonymous political donations could soon be tax deductible. Federal political contributions are donations that were made to a registered federal political party or a candidate for election to the House of Commons.

However the irs does not allow contributions to any. All four states have rules and limitations around the tax break. There are five types of deductions for.

The CFC is comprised of 30 zones. The Commission maintains a database of individuals who have made contributions to federally registered political committees. Only those donations or contributions that have been utilizedspent during the campaign period as set by the comelec are exempt from donors tax.

The IRS makes it clear that you cannot deduct contributions that you make to any organizations. There are five types of deductions for individuals work-related itemized education. Each of these zones has.

In other words you have an opportunity to donate to your candidate. Are federal campaign contributions tax deductible Friday June 10 2022 In a nutshell the quick answer to the question Are political contributions deductible is no. Data on individual contributors includes the following.

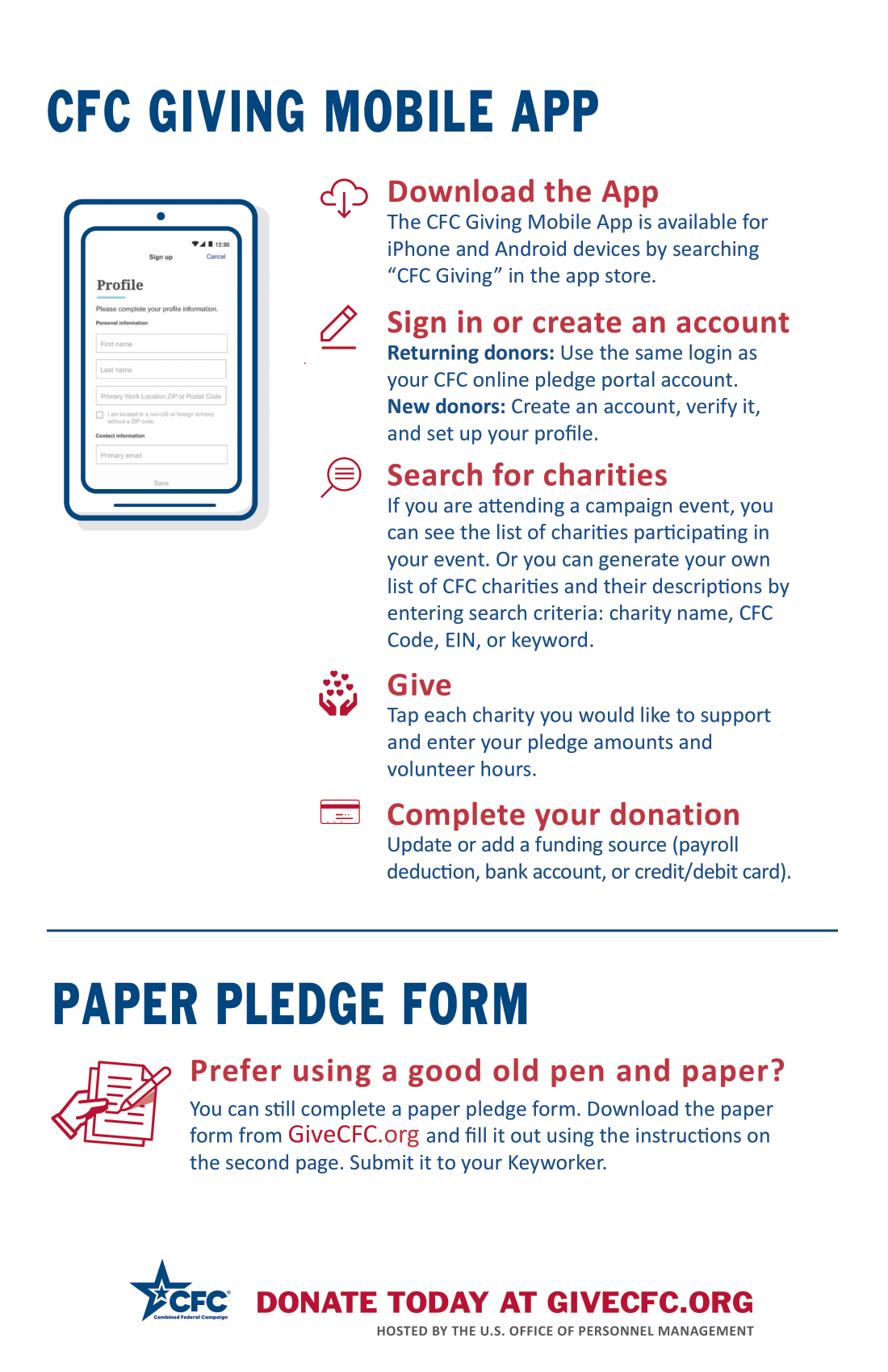

Are Federal Campaign Contributions Tax Deductible. Under the Federal Election Campaign Act the Act certain contribution limits are indexed for inflation every two years based on the change in the cost of living since 2001. Thank you for contributing through the Combined Federal Campaign CFC.

Act Now To Lower Your 2021 Taxes Support Columbia S Agriculture Park Build This Town Campaign For The Agriculture Park

Are Political Donations Tax Deductible Picnic Tax

Corporations Are Spending Millions On Lobbying To Avoid Taxes Public Citizen

Are Political Donations Tax Deductible Credit Karma

Are Political Contributions Tax Deductible Tax Breaks Explained

Giving Just Got Easier For Retired Federal Employees Habitat For Humanity Of Greater Los Angeles

The Value Of Donor Research Free And Fee Resources And Their Pros An

Combined Federal Campaign Donate Through The Combined Federal Campaign Contribute The Foundation For The Malcolm Baldrige National Quality Award

Donate To Voteriders Voteriders

Are My Donations Tax Deductible Actblue Support

Make A Donation To United States Deputy Sheriff S Association

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Political Contributions Lobbying Executive Compensation Module 5 Deductions And Losses In General Coursera

Contribute Robert Husseman For House District 21

Are Your Political Contributions Tax Deductible Taxact Blog

Are Political Contributions Tax Deductible Anedot

Combined Federal Campaign Opens September 1st Airman Heritage Foundation Airman Heritage Foundation